Is The Next Housing Bubble Near?

Elections create change and often times lead people to wonder about their financial security. There has been speculation that the next housing bubble is near so we asked local realtor Susan Ramsey to weigh in on what experts expect to happen with housing in our area. Here are her thoughts...

You can read articles that sway either way with convincing arguments and data to support. My opinion is based on my real estate experience since 1991 and observing what I now see happening in the market, which is also backed by data from The Cromford Report.

I believe the market is definitely in a HOUSING SHIFT. Shifts are inevitable in every aspect of life, housing is no different. During the time period of 2005 – 2006 there were several factors affecting housing:

1) Lender regulations to obtain a home loan or home equity line of credit were changed to be much more lenient, allowing borrowers to obtain a home mortgage with little documentation and stated income.

2) Investors were allowed to purchase multiple homes with loans and they flocked to Arizona for low housing prices and favorable Anti-deficiency laws.

3) There was a shortage of new construction.

More buyers suddenly came into the marketplace for the above reasons which fueled a housing shortage and rising home prices. I remember the lottery system for nearly every new home construction site with prices rising 2-3% a month! Housing inventory in 2005-2006 dropped to nearly 5,000 homes for sale. The median home size was 1,670 square feet with a median sales price of $265,000. Fast forward to October 2018 the home inventory for resale homes is a little over 18,000 homes for sale, with many new construction subdivisions and master planned communities, all with NO lottery system. 2018 median home size is 1,803 square feet with a median sales price of $260,000. Lending standards are stricter, interest rates are LOWER!

Yes, the median price is nearly the same as 2006 but you get a larger home with a lower interest rate!

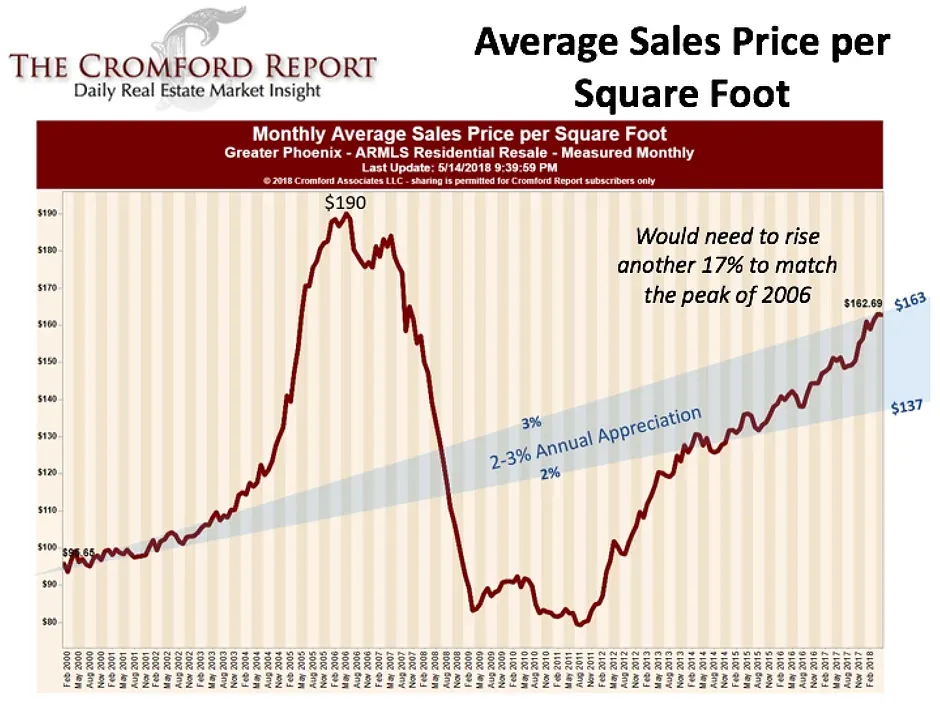

The Chart below indicates the reality that if the bousing bubble of 2005-2006 had NEVER happened, our current market is exactly where it should be with normal appreciation.

There are new players in the game with “Flip Transactions” by OPENDOOR and OFFERPAD accounting for 37% of Flip Sales. The traditional “Investor Flips” are still strong.

Fewer Homes are on the market, investors are still buying and holding the lower priced homes or flipping. Companies like OFFERPAD and OPENDOOR are changing the traditional model. Home prices are rising but not at an unsubstantiated rate. Home appreciation is settling in to a normal pattern. Buyers are resisting overpriced homes with 47% of all ARMLS listing seeing price reductions. Well priced homes are still seeing multiple offers, but not grossly over list price offers. Buyers with higher down payments and earnest monies are winning the deal.

The Ramsey Team is here to navigate FOR YOU!

Sellers… We will sell your home for top dollar in today’s market!

Buyers… Keep Calm – We will find you the perfect new or like new home!

We love what we do and will not stop until Mission is Accomplished!

Susan Ramsey

The Ramsey Team, Keller Williams Realty Professional Partners